I’m not here to guess and I won't pretend to predict the unknowable. No one knows exactly how this shutdown will land, and the past doesn’t necessarily dictate the future. What I can offer is firsthand evidence.By 2013 I was a seasoned agent, and I sold straight through the 2013 and 2018 to 2019 shutdowns in Northern Virginia and DC. Here is what actually happened then and how those lessons apply now.

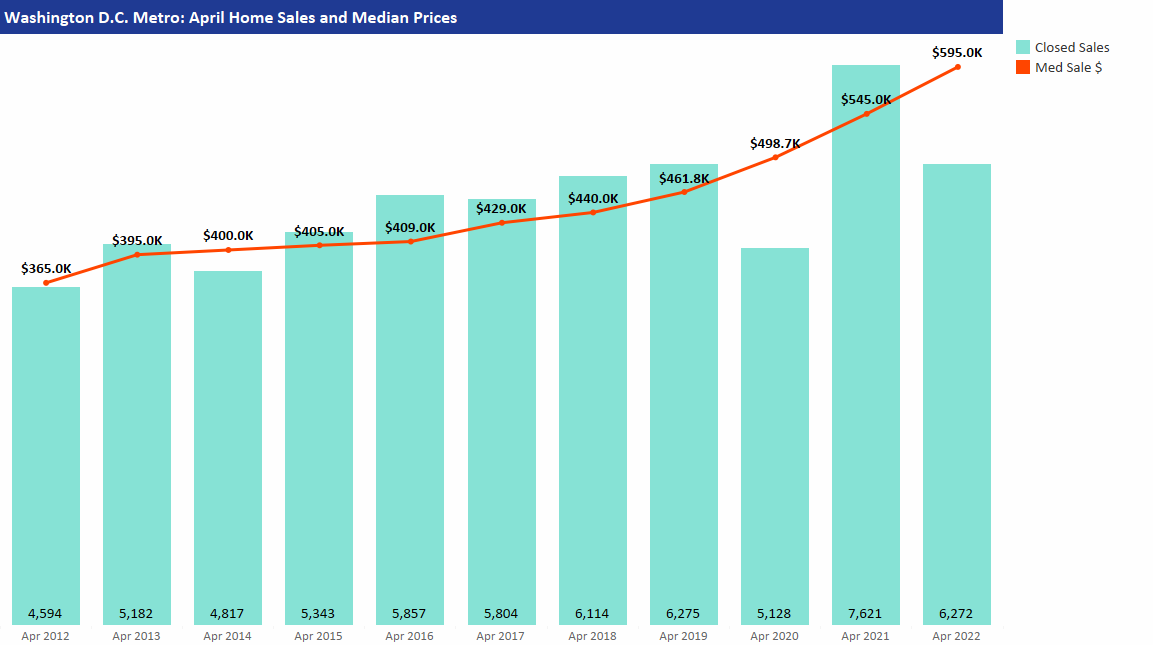

I remember 2013 vividly because it wasn’t “normal” then. No one knew what a Government shutdown meant. The previous shutdown had been back in 1995–96, pre internet and 24 hour news channels. The shutdown started on October 1, 2013, buyers and sellers genuinely didn’t know what it would do or how long it would last. Open houses went quiet instantly. We were in uncharted territory, even though the headlines today make it sound like politics as usual, that was not always the case. The DC metro median sale price that year was about $400,000, and the immediate hit showed up one month later: November 2013 closed sales fell 13.7% year-over-year, directly tied to the October shutdown. That’s the pattern I remember on the ground. When traffic stops, it's followed by offers, and the ones brave enough to transact during that time were rewarded with better terms in what was an otherwise strong market that was starting to recover after the 2008 financial crisis. (Congress.gov)

The next big episode, December 22, 2018 to January 25, 2019, lasted 35 days, the longest ever. It hit sentiment in an already soft late-2018 market. Early in January, Bright MLS, our MLS and data provider, reported sales running roughly 30% below the same period a year earlier. It wasn't subtle and we felt the freeze. The IRS normally handles the income-verification transcripts lenders rely on; during the shutdown, that processing stalled. If you were under contract, you likely faced delays and, at worst, a risk of default through no fault of your own. By spring, activity normalized and pent-up demand flowed into a stronger market, recapturing most of the lost transactions.

When tens of thousands of federal employees and contractors can’t predict their next paycheck, they don’t spend money, and that effect ripples through the regional economy.

Can You Get a Mortgage?

Here’s the oddity: in recent shutdowns, 10-year Treasury yields often slip as investors pivot to safe assets, and mortgage pricing usually follows. The irony isn’t lost on me, when government isn’t functioning, its bonds become the safe investment . In past shutdowns the 10-year has fallen roughly 10–60 basis points, which can translate into about a quarter- to half-point drop in long-term mortgage rates. It’s not automatic but something to look out for should you be in the market or might want to refinance a higher rate.

Northern Virginia and Washington DC have a larger percentage of Government back loans than many other markets. Nearly 40% of local mortgages are government-backed FHA or VA loans. When FHA, VA, or parts of HUD are on skeleton crews, timely underwriting becomes unpredictable. VA financing is a pillar of this market and it depends on federal staff, so a prolonged shutdown can sideline these buyers entirely. If the National Flood Insurance Program lapses during a shutdown, homes that require flood insurance cannot close until coverage resumes.

Will Prices Come Down?

Does a shutdown bring prices down? Ultimately not as a result of the shut down. Not in a quick, mechanical way. In 2013 annual prices were still higher versus 2012, Fun fact, between 2012 and 2014, median home prices in our area went from $400,000 to $405,000. A reminder that the last 5 years is not normal. The same for 2018 to 2019, the median price went from $440,000 to $459,000. The DC Metro 2024 median sales price was $605,000 and 2025 YTD we are at $625,000.

So what does this one mean, right now, for Northern Virginia and DC?

If you’re buying, especially with VA or FHA financing, assume underwriting takes longer factor in contingencies to protect against factors out of your control. From a more practical perspective, expect less competition and if you find an anxious seller or inexperienced agent that begins to panic, leverage this to your advantage. Past shutdowns shows that this is a moment in time that will pass, depending on how long this last. Don't expect long term price declines but you will probably pay less today than you would have otherwise.

The immediate risks are longer days on market, contracts falling throughs, and the real possibility of concessions. Don’t overreact to a slow weekend, but don’t assume this blows over in a week either; yes, 2013–14 and 2019 normalized quickly, but each cycle is its own animal. Not everyone can time the market or afford to carry for months, so be clear about your runway and price for the market you actually have. Demand had only begun to flicker back before this; we went into the shutdown leaning buyer’s market, and it’s likely to look even more so on the other side.

Bottom line for our region: short shutdowns bruise timelines more than prices. The pain shows up first in open-house traffic, then contracts, and then only possibly temporary lower prices. If this becomes a long one, the damage grows with it.

Khalil El-Ghoul

Khalil El-Ghoul is a seasoned real estate broker actively helping sellers and buyers throughout Northern Virginia, DC, and Maryland. Known for his no-nonsense approach, Khalil combines expert market insight with honest, objective advice to help buyers and sellers navigate every type of market—from calm to chaotic. If you’re looking for clarity, strategy, and a trusted partner in real estate, he’s the one to call. 571-235-4821, khalil@glasshousere.com

.jpg)